Minimum credit card repayment calculator

You use your credit card to pay for basic needs because you cant afford to pay cash Strive to only make credit card purchases that you could pay for right now with your checking account. The calculator displays the total credit card balance and the total minimum payments.

The credit card calculator allows to create scheduled table of payments taking into accounts such important aspects as the monthly interest rate.

. Passport Personal Loan Petrol Price Recurring Deposit SBI Credit Card Savings. Credit card repayment calculator Work out how long it will take you to repay in full the balance on your credit card and what the total cost will be. 5 or 25 of the balance whichever is higher or if less than 5 your statement balance.

Credit card companies tell customers about the minimum payment as a guideline to avoid extra fees and increased interest rates. 5 or a minimum of Rs200. Adjust the minimum repayment percentage on this calculator to match the amount shown on your latest credit card statement.

Baca Juga

Since the passage of the Credit Card Accountability Responsibility and Disclosure CARD Act of 2009 credit card issuers have been explaining the cost of making only minimum payments. The minimum payment is usually a percentage so how much youll pay will depend on a couple of things the amount you owe and your credit card providers rules. For Credit Card agreements made on or after 23 March 2011.

For Credit Card agreements made before 23 March 2011. All credit card calculators. Credit card payoff calculator.

A credit card payment calculator is just one tool that may prove to be useful when you want to find out just how long it could take to pay off your debt. Repaying a higher amount. 349 per month.

You are only paying the minimum amount required If you pay only the minimum your credit card company charges more interest keeping you in debt longer. Ways to Pay Off 3000 in Credit Card Debt. Whether you plan to make your credit cards minimum payment or think you can afford to pay a little more each month enter that amount here to find out how long it could take you to get out of debt.

0 APR Credit Card. If youre more concerned with. Make sure to notice how its not just the interest charges you pay that cost you so much but its also the interest you could be earning on those charges if you were investing them rather than paying them to the credit card company that hurts so bad.

It is also capable of revealing an annual detailed forecast of the balance of the credit card with regard to the repayments that are made showing the amount of money that is left after each. Usually other credit cards charge interest from date of withdrawal with interest rates as high as 35 per. Different cards will attract different levels of credit card interest and you may have opted to only pay the minimum repayment rather than a set amount.

0 APR Credit Card. It creates a repayment schedule based on the repayment strategy. Depending on the balance the credit card statements will provide repayment information like.

If you repay a higher amount than the minimum repayment this calculator assumes that amount stays the same each month. This has been a guide to the Credit Card Minimum Payment Calculator. Credit card compare tool.

This percentage is likely to be higher than in the above scenario maybe between 2 and 5 and it will be applied toward both your principal and interest charges. For instance use a credit card calculator so that you can get an accurate estimate of what credit limit you can receive. Some credit card issuers calculate the minimum payment as a straight percentage of the balance at the end of your billing cycle.

Getting a 0 APR credit card isnt the only way to pay off 3000 in debt though. Interest default charges and any payment protection insurance premium plus 1 of the principal or 25 of the balance or 5 whichever is. You may also take a look at the following useful articles Secured vs Unsecured Credit Card.

Here we provide you with some examples of the calculator used to calculate the Credit Card Minimum Payment done by the credit card holder. Calculator of Loan Repayment. Depending on the calculator you can find out the monthly payment amount that is required to pay your credit card balance in full or it can provide you with your estimated purchases and the.

By paying more than your minimum monthly repayment you can pay off your credit card faster and pay less interest. Depending on the calculator you can find out the monthly payment amount that is required to pay your credit card balance in full or it can provide you with your estimated purchases and the. Charges on revolving credit.

See how long it could take to pay off your credit card debt with Credit Karmas debt repayment calculator. The problem is that just making the minimum payment extends your debt repayment timeline. In order to pay off 10000 in credit card debt within 36 months you need to pay 362 per month assuming an APR of 18.

The minimum repayment reduces each month as the card balance reduces. Just enter your current balance APR and. Check Offers Reward Points Eligibility to Apply Online.

The repayment schedule shows each credit card and also the monthly payment you. Calculate how long it will take to pay off your credit card balanceAlternatively use the second calculator to work out how much you should pay each month to eliminate your credit card balance completely in a set period of time. HDFC Freedom Credit Card - Know all the features Benefits offered by HDFC Freedom Credit Card.

0 Interest on Cash Withdrawal IDFC FIRST Bank Credit Cards offer ATM cash withdrawals at 0 interest until your due date. If not paid by the due date the charge may range from 0 to 35 depending on your card provider. A credit card payment calculator is just one tool that may prove to be useful when you want to find out just how long it could take to pay off your debt.

Use our credit card interest calculator and take control of your finances to find out how long it will take you to pay off your monthly interest payments. A late payment fee is charged to your account if you fail to pay the minimum repayment amount stated in your agreement. In fact there are many options to consider each suited for slightly different situations.

Check your credit card statement to see how long it may take. The calculator assumes you stop charging more so the balance stops rising due to spending. Use these credit card repayment calculators to work out effective strategies to pay off your credit card debt.

While you would incur 3039 in interest charges during that time you could avoid much of this extra cost and pay off your debt faster by using a 0 APR balance transfer credit card. A typical minimum repayment will be around 1-25 of how much you owe usually including any interest or charges such as late fees or 5-25 whichever is higher.

Download Credit Card Payoff Calculator Excel Template Exceldatapro

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy

Credit Card Payment Calculator

Credit Card Minimum Payment Calculator Step By Step

Credit Card Minimum Payment Calculator Step By Step

How To Calculate Credit Card Interest In Excel 3 Easy Steps Exceldemy

Credit Card Payoff Calculator Excel And Google Sheets Free Download

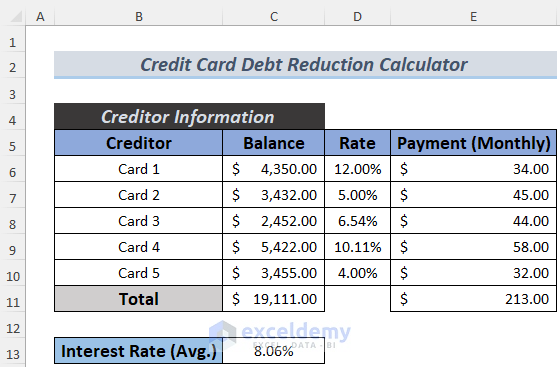

How To Make Credit Card Debt Reduction Calculator For Excel

Debt Repayment Calculator Credit Karma

Repayment Credit Card Calculator Credit Card Repayment Calculator Cred

Credit Card Calculator Interest Co Nz

Free 9 Sample Credit Card Payment Calculator Templates In Excel

Credit Card Debt Payoff Spreadsheet Excel Templates

Credit Card Payoff Calculator Compare Options Nerdwallet

Free Credit Card Payoff Spreadsheet Get Out Of Debt In 2022

How To Make Credit Card Debt Reduction Calculator For Excel

Credit Card Interest Calculator Find Your Payoff Date Total Interest